Table of Contents

The IDFC FIRST Bank Fixed Deposit offers 7.50% interest rate. We offer different features like no penalty on early withdrawal, competitive interest rates, high returns and more. Open Tax Saving FD account online now! Jan 12, 2021 The bank of India is not offering any loan against the FD of any other bank. Loan is offered against FD at the rate of 5% to 7.7%. The minimum loan tenure is restricted to maximum tenure of FD. Documents Required Opening Fixed Deposit Accounts. Various documents required to open fixed deposit account in the bank of India are like:-Identity.

- 3 United Bank of India FD Interest Rates for Senior Citizens

- 3.2 Features of United Bank of India Fixed Deposits

About United Bank of India Fixed Deposit

Who wants to lose their money in stock markets? Nobody. Everybody looks for a safe instrument that will help them to fetch a good amount of returns along with the safety of the principal value. Fixed deposit is one such instrument that provides higher returns subject to your lock-in period for a specified period of time. It’s a better idea to opt for FD instead of keeping your money idle in savings bank account that barely generates returns on your savings. Fixed deposits are a secured instrument i.e keeping you in ‘no risk’ zone as it keeps you away from all the fluctuations of the stock market. How does it really matters when one looks for the safety of money employed? Well, it does matter as fixed deposits accumulate the hard earned money of its customers hoping for better returns. And if you’re planning to opt for United Bank of India Fixed Deposit, it’s better to go through the details of the time period where you can maximize your chances of earning better returns.

When you choose United Bank of India, be assured that you will be getting competitive interest rates for different tenures. The FD interest rates of United Bank of India is subject to change dependent upon the market changes and the bank’s necessity for internal liquidity. The bank offers specialized fixed deposit schemes such as ‘United Tax Savings Income Plan’ and ‘United Bonanza Savings’, apart from offering general fixed term deposits.

If you wish to invest in United Bank of India Fixed Deposit, then you need to know that this account remains fixed for a predetermined time period and interest is payable monthly, quarterly, half yearly, yearly or on maturity in accordance of the account holder. The periodic time frame for your investment in FD ranges from 15 days to 120 months.

United Bank of India FD Interest Rates March 2021

Let’s check out the revised rates of Domestic Term Deposit (Rate of interest in % p.a.)

Interest Rates of Domestic Term Deposit (Rate of interest in % p.a)

| Period of Deposit | Rate (% p a) for amount up to INR 2.00 crore | Rate (% p a) for amount above INR 2.00 crore |

|---|---|---|

| 7 days to 14 days | 4.00 | 4.00 |

| 15 days to 29 days | 4.00 | 4.00 |

| 30 days to 45 days | 4.00 | 4.00 |

| 46 days to 60 days | 4.00 | 4.00 |

| 61 days to 90 days | 4.50 | 4.50 |

| 91 days to 180 days | 5.00 | 4.50 |

| 181 days to 269 days | 5.75 | 4.50 |

| 270 days to less than 1 year | 6.00 | 4.25 |

| 1 Year | 6.50 | 4.35 |

| Above 1 year to less than 2 years | 6.25 | 4.25 |

| 2 years to less than 3 years | 6.25 | 4.25 |

| 3 years to less than 5 years | 6.00 | 4.25 |

| 5 years and above | 6.00 | 4.25 |

*The Rate applicable to all senior citizens includes Retired Staff of age 60 years and above will be 0.50% over the rate payable for above 1-year tenors.

The proposed rates shall apply to fresh deposits and for renewing term deposits. The Interest rate on United Bank of India Tax Saving Schemes and NRE/NRO Deposits shall be in the same manner as of the above-proposed rates for Domestic Retail Term Deposits. But, no staff benefit will be entitled to United Tax Savings Deposit Scheme. The revised rates of Interest shall be put into effect on Domestic Term Deposits from Co-operative banks.

United Bank of India FD Interest Rates for Senior Citizens

United Bank of India Staff and Retired Staff are entitled to be paid interest rates which will be 1 % above the applicable rate for Retail Term Deposit. The Retired Staff of age 60 years and above will derive both the benefits of staff(1%) and Senior Citizen (0.50%) for Deposits of above one year.

The ex-employees who were mandatorily been retired, dismissed or removed from Bank’s services as a measure of disciplinary action or even resigned from Banks’ services will not be entitled to derive the above benefits (H.O. Circular No. PD/DIR/03/O&M- 0145/06-07 dated 30.05.2006).

Premature Withdrawal

Fixed Deposit Rates In India

If you are seeking for premature withdrawal of your FD, you need to consider the following instructions issued by United Bank of India for such undertakings:

- Your term deposit should closely premature within 7 days from the deposit date: In such case, no interest will be paid.

- If your FD closely premature beyond 7 years and the deposit is withdrawn: 1% penalty will be imposed on the rate of interest applicable for the period when the deposit remained with the bank.

- If prematurely withdrawn for reinvesting the deposit for a period exceedingly the residual period of the actual deposit undertaken, interest will be paid at the rate applicable on the date of actual deposit for the period for which the deposit remained with the bank, without the imposition of any penalty of 1%.

- If the term deposit is renewed by prematurely withdrawing it for a period lesser than the remaining period of deposit, a penalty will be imposed @ 1%.

United Bank of India Fixed Deposit Calculator

Want to know how much you have earned on your Fixed Deposits? Check out the FD calculator that assists you in calculating the maturity value of your investment. All you need to do is to enter the principal amount and the period of investment in order to find the amount of interest earned on FD.

Features of United Bank of India Fixed Deposits

Let’s discuss the features of United Bank of India Fixed Deposits which can be really helpful for you in planning for your FD:

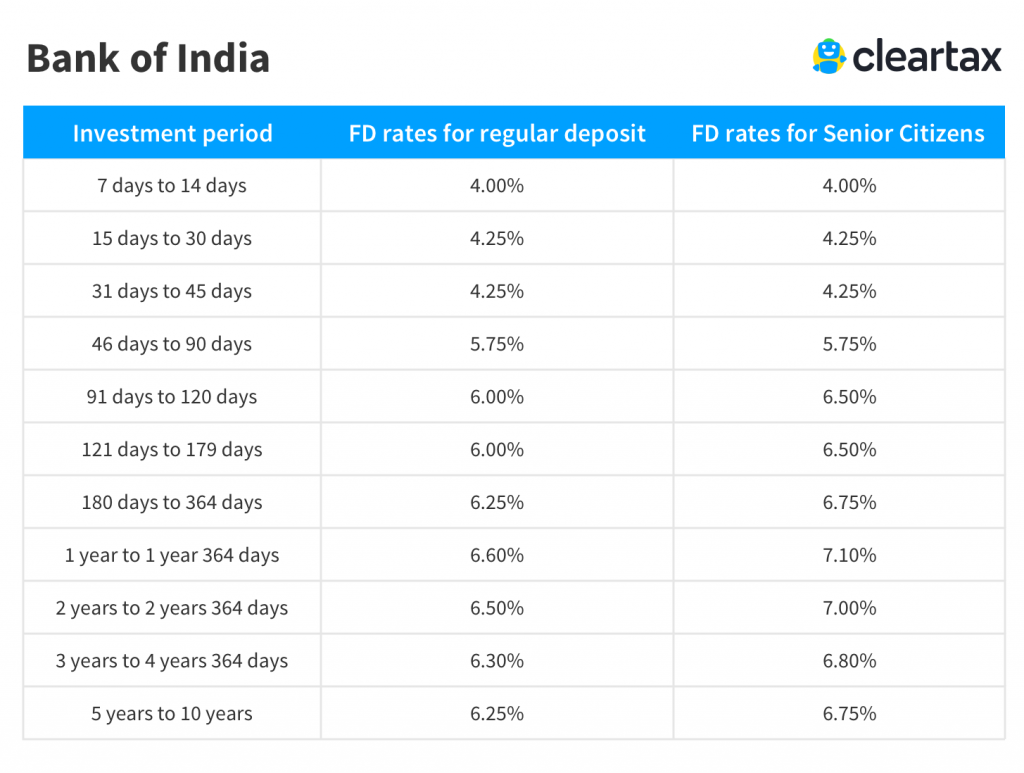

Bank Of India Fixed Deposit Rates Of Interest

- Minimum period of deposit is 7 days and a maximum period of 5 to 10 years.

- A penalty fee is levied for premature withdrawal of retail fixed deposits (applicable for lower deposits of ₹ 100 lakh).

- Auto renewal facility for Fds is available

- The bank provides NRO, NRE and FCNR fixed deposits for NRIs.