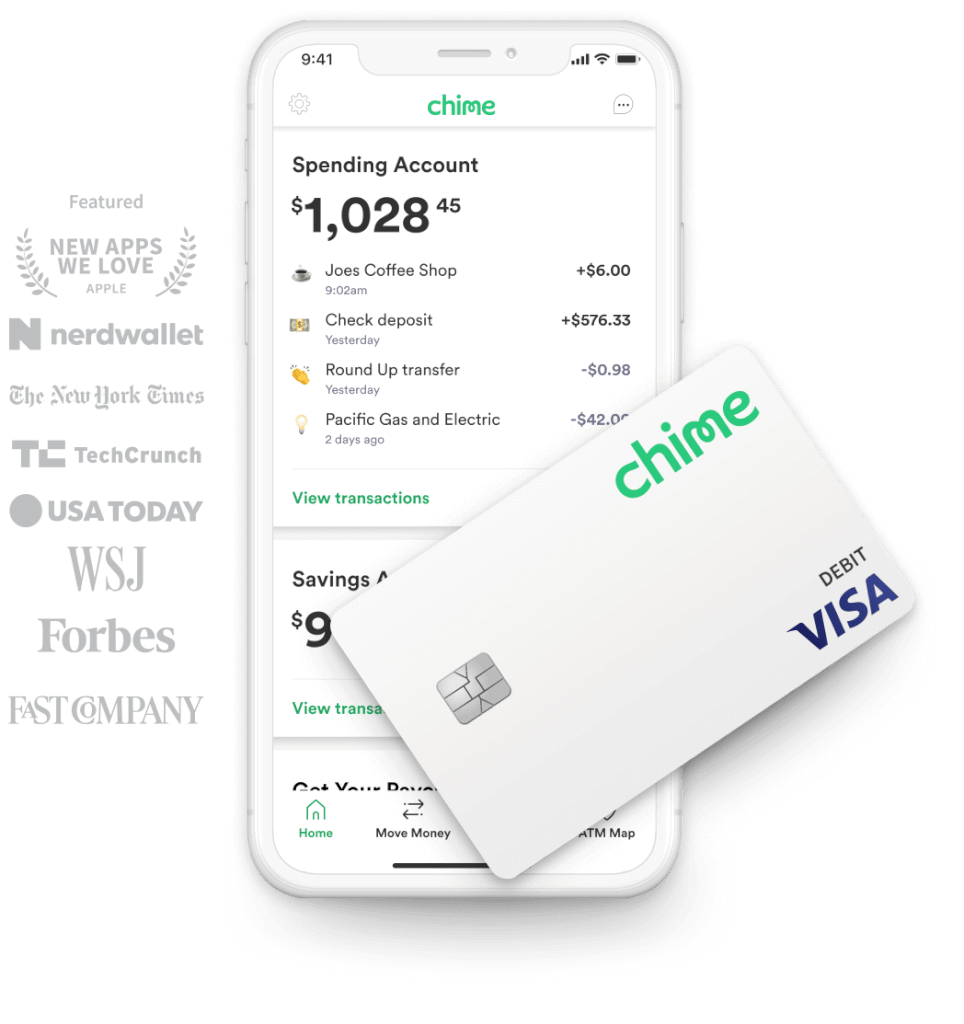

Well, cashing a check for someone else technically depends on a specific bank’s policy. In most banks, they allow you to cash a check for someone, but you must have their government-issued identification. Cashing Fee: Up to $8. Your most convenient option can be your local Walmart. Faster mobile check cashing! Introducing Ingo® Money, the easy way to cash your check to your GoBank account in minutes, right from your mobile device. Download: Add the Ingo Money App to your smartphone. Enroll: Create your profile and link your GoBank account right in the app. Snap: Follow the prompts to take pictures of your check.

Cash paychecks, personal checks, business checks, money orders and more, anytime, anywhere. Get your money in minutes in the accounts you choose, as good as cash and safe to spend!

With Ingo Money, it’s your money on your terms.

All checks subject to review for approval. Fees may apply.

INGO MONEY APP

Cash a check on your mobile device.

Get your money in minutes in most bank, PayPal or prepaid card accounts, buy an Amazon.com Gift Card, pay credit cards or pick up cash at a MoneyGram agent location.

No check cashing lines. No take-backs. No worries.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

Cash a check with Ingo Money and, if your check is approved, get your money in minutes in your bank, prepaid card or PayPal account, buy an Amazon.com Gift Card, pay credit card bills or pick up cash at a MoneyGram agent location.

No check cashing lines. No take-backs. No worries.

Simply link your accounts in the Ingo Money App, cash a check and choose where you want to send your money. Or split a check and send money to more than one place.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

HOW THE APP WORKS

Cash a check in three easy steps.

Take pictures of your check

Choose when you want your money

Choose where to send your money

Fund most bank, prepaid or PayPal accounts, pay credit cards or split a check to multiple accounts

- Sign in and tap ‘Cash a Check’

- Take a photo of the front and back of your check

- Choose WHEN you want your money

- Choose WHERE you want your money

- Submit your check for review

The review process typically takes just a few minutes. If your check is approved, you may also be asked to void it and submit a voided image.

Take pictures of your check

Choose when you want your money

Choose where to send your money

Fund most bank, prepaid or PayPal accounts, pay credit cards or split a check to multiple accounts

Download the Ingo Money App

Enroll to create your user profile

Link debit, prepaid, credit card and PayPal accounts

Your’re ready to Ingo

Cash checks in minutes for a fee; in 10 days for free

Download the Ingo Money App

Enroll to create your user profile

Link debit, prepaid, credit card and PayPal accounts

/Balance_Pay_To_Cash_Checks_315313_V3-74332e1e27cf4ba48c7cc043660d07ce.png)

Your’re ready to Ingo

Cash checks in minutes for a fee; in 10 days for free

GET THE APP

Install the Ingo Money App and create your user profile.

Download

Install the app from the App Store℠ or the Google Play™ Store. Data rates may apply.

Enroll

Create your user profile and link your debit card, prepaid card, PayPal and credit card accounts.

Snap

Follow the screen prompts to snap a photo of the front and back of your check.

Go

Get your money in minutes for a fee or in 10 days for no fee. Whichever option you choose, if your check is approved and your account is funded, your money is as good as cash and safe to spend.

All checks subject to review for approval. Fees may apply.

Most credit card issuers post funds within 24 hours.

FAQCONTACT USCAREERS

SUPPORTED ACCOUNTS & NETWORKS

The Ingo Money App may be used by identity-verified customers to cash checks issued on U.S. financial accounts to fund: (1) most debit, prepaid and credit card accounts issued by hundreds of U.S. financial institutions including Chase®, Bank of America®, Citi®, Wells Fargo®, American Express®, U.S. Bank®, PNC Bank®, Capital One®, HSBC Bank USA, TD Bank, Discover®, Synchrony Bank, First Premier® Bank, MetaBank® and The Bancorp Bank; (2) PayPal™, PayPal™ for Business and PayPal™ Prepaid MasterCard® accounts; (3) Amazon.com Gift Cards; (4) most prepaid cards, including Chase Liquid®, Wells Fargo EasyPay®, Regions Now Card®, BB&T MoneyAccount®, NetSpend®, Green Dot® Prepaid Debit, Walmart MoneyCard®, H&R Block® Emerald Card®, ACE Elite™, RushCard®, AccountNow®, Kroger® 1-2-3 REWARDS®; and (5) cash pick-up at MoneyGram’s participating U.S. locations. Funds may also be used to pay retail credit card bills from thousands of retailers including Walmart®, Target®, Costco®, Home Depot®, Lowe’s®, BestBuy®, Gap® and Old Navy®. You can also access the Ingo Money service in dozens of mobile banking apps including American Express Serve® and Bluebird℠ by American Express. Ingo Money participates in the Visa®, MasterCard®, American Express®, Star®, Pulse®, NYCE® and Maestro® payment networks.

LEGAL DISCLOSURE

Ingo Money is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

Amazon.com Gift Cards (“GCs”) sold by First Century Bank, N.A., an authorized and independent reseller of Amazon.com Gift Cards. Except as required by law, GCs cannot be transferred for value or redeemed for cash. GCs may be used only for purchases of eligible goods at Amazon.com or certain of its affiliated websites. For complete terms and conditions, see www.amazon.com/gc-legal. GCs are issued by ACI Gift Cards, Inc., a Washington corporation. All Amazon ®, ™ & © are IP of Amazon.com, Inc. or its affiliates. No expiration date or service fees.

Can't Cash Stimulus Check

Cash pick-up service is provided by MoneyGram Payment Systems, Inc., subject to the MoneyGram Terms and Conditions available at https://www.moneygram.com/us/en/terms-and-conditions; availability subject to agent operating hours and compliance with regulatory requirements. MoneyGram cash payout transactions are available between $5.00 and $1,000.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with these companies. All rights reserved.

© 2013 – 2020 Ingo Money, Inc.

Looking to cash a check without a bank account? You aren't alone. More than 5% of American households don't have a bank account. If you're one of the 'unbanked' masses, here's how to cash a check.

Ways to Cash a Check without a Bank Account:- Go to the Issuing Bank

- Use a Retail Store

- Find a Check Cashing Center

- Deposit Using a Prepaid Account

Depending on which method you choose, you may pay fees or a percentage of your check. Keep reading to learn more.

Cashing a Check at the Issuing Bank

Visiting the issuing bank is one of the easiest ways to cash a check. You can find the issuing bank's name right on the check. If the bank has a branch near you, head over to cash the check.

This method typically costs the least of any cash checking method other than your own bank account. Some issuing banks, like Capital One, don't charge a fee. Others charge based on the amount of the check.

When you visit the issuing bank, the teller can look up the availability of funds immediately. If the funds are available, they will then deduct the fee from the cash you receive.

You can usually cash both personal AND payroll checks at the issuing bank.

If you cash paper checks often, you should get a checking account to avoid fees. Chase is a convenient option because of their large number of ATMs and branch locations.

Cashing a Check at Retail Stores

You can do more than just shop at retail stores. Many places offer check cashing at their service desk. The most popular retail stores offering these services include:

- Walmart: Walmart can cash checks up to $5,000 with the exception of two-party personal checks. You may only cash two-party personal checks up to $200.

You can cash pre-printed payroll, government, tax, cashiers, 401(k) distribution, and insurance settlement checks. Walmart charges a flat fee for checks up to $1,000. The fees double for checks over $1,000.

- Money Services: You can find Money Services in many grocery stores, such as Kroger, Fred Meyer, King Soopers, Ralph's, and Fry's. You can cash payroll, government, income tax refund, insurance settlement, and business checks at Money Services.

They don't accept personal checks. Money Services charges a fee and can cash checks up to $5,000.

- Kmart: Kmart 'Shop Your Way' members may cash checks at Kmart. They accept government, payroll, and tax refund checks up to $2,000.

You may also cash two-party checks up to $500. Kmart charges a fee, but it's much lower than many other retail outlets.

- Food Lion: Food Lion cashes payroll checks and tax refund checks up to $1,000. They also cash rebate checks and traveler's checks (up to $499.99).

They do not cash personal or two-party checks. You also can't cash handwritten payroll checks.

Many retailers and banks charge a flat fee for specific dollar amounts. Other facilities may charge a percentage of the check amount.

Cashing a Check at a Check Cashing Store

If you are desperate, you may consider cashing a check at a check cashing store. This method may seem convenient, but it will likely be the most expensive option.

Check cashing centers charge a fee for the convenience of the availability of the funds. The fee is a percentage of the check amount, usually 1% to 5%.

You get the full amount of the check right away. If you had a bank account, you would likely have to wait at least one business day for the funds to be available.

Essentially, check cashing centers give you a short-term loan by giving you the cash right away. The service fee is their 'interest' for the loan.

How to Cash a Check Without an ID: Banks and check cashing facilities have to ask you for government-issued ID in order to cash a check. If you don't have an ID, your best bet is to cash the check online via a mobile app.If you don't have a reloadable prepaid card or a bank account, you may have to resort to endorsing the check over to a family member or friend to cash it for you.

Cashing a Check Using a Prepaid Account

If you have a prepaid debit card, you may be able to deposit your check into the prepaid debit card account. Many services, such as InGo, allow you to deposit the check right from your mobile phone.

You take a picture of the front and back of the check and wait for approval. If approved, the funds will appear in your prepaid debit card account.

If you aren't comfortable sending the check via mobile app, some prepaid debit card companies have partner locations where you can reload your card.

As an added bonus, if you have recurring checks, such as payroll checks, you can request direct deposit right to your prepaid debit card account.

Endorse the Check to a Family Member or Friend

If you want to save the few dollars it may cost to cash an occasional check, consider asking a friend or family member for help.

This isn't a favor you want to ask for regularly, but it can help when you are in a bind. In order for someone else to cash your check, you have to endorse it over to them.

You sign the check as you normally would and then write 'pay to the order of' and the person's name underneath your signature. It goes without saying you should only do this with someone you trust.

Bottom Line

Cashing a check without a bank account is possible. But it will probably cost you money.

When you have a bank account, check cashing is often a part of the services provided under the account agreement. Without a bank account, you have to think outside of the box and typically pay for the convenience of cashing a check.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

2 Forms Of Id To Cash Check

Read Next:

No Id Check Cashing Places

|

|

|