- Chime Bank Direct Deposit Time

- Chime Mobile Direct Deposit Time

- Chime Direct Deposit Holiday Delay 2020

The timing of your deposit depends on when the sender initiates the payment to your Chime account. Deposits post Monday-to-Friday throughout the day. If you do not see your direct deposit in your account, it means that we haven't received it yet. As soon as your direct deposit arrives you will receive a push notification and an email to let you know! @quarterris @Chime why didn't @Chime let customers now that there is problems receiving direct deposits today. My lights just got turned off cause my deposit was supposed to be here at 12 pm My lights just got turned off cause my deposit was supposed to be here at 12 pm. Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. And may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Fee-free overdraft up to $100.¹ Get paid up to 2 days early with direct deposit.² Grow your savings.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Overdraft fee-free with SpotMe

We’ll spot you up to $100 on debit card purchases with no overdraft fees. Eligibility requirements apply.¹

Get paid early

Set up direct deposit and get your paycheck up to 2 days earlier than some of your co-workers!²

Say goodbye to hidden fees³

No overdraft. No minimum balance. No monthly fees. No foreign transaction fees. 38,000+ fee-free MoneyPass® and Visa Plus Alliance ATMs. Out-of-network fees apply.

Make your money grow fast

0.50% Annual Percentage Yield (APY)⁴. Set money aside with Automatic Savings features. And never pay a fee on your Savings Account.

Stay in control with alerts

You’re always in-the-know with daily balance notifications and transaction alerts

Security & support you can trust

Serious security

Chime uses secure processes to protect your information and help prevent unauthorized use

Privacy and protection

Your deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank N.A.; Members FDIC

Friendly support

Have questions? Send a message to our Member Services team in the app or check out the Help Center.

Get started

Applying for an account is free and takes less than 2 minutes.

It won’t affect your credit score!

Learn how we collect and use your information by visiting our Privacy Policy›

Here at Chime, we’re all about bringing you financial peace of mind. Whether it’s getting your paycheck earlier,¹ getting support when you overdraft, or working on your credit history, we always have your back. And the first step to unlocking these awesome features is by setting up direct deposit.

If you haven’t set it up yet, you’re in the right place! We’ve outlined two easy ways to start getting your paycheck into your Chime account. 😎

In order to set up direct deposit, you’ll need to have your Routing Number and an Account Number handy. You can find this info in your Chime app, under Settings. Tap that gear icon on the top left of your screen and you’ll see it under Account Information.

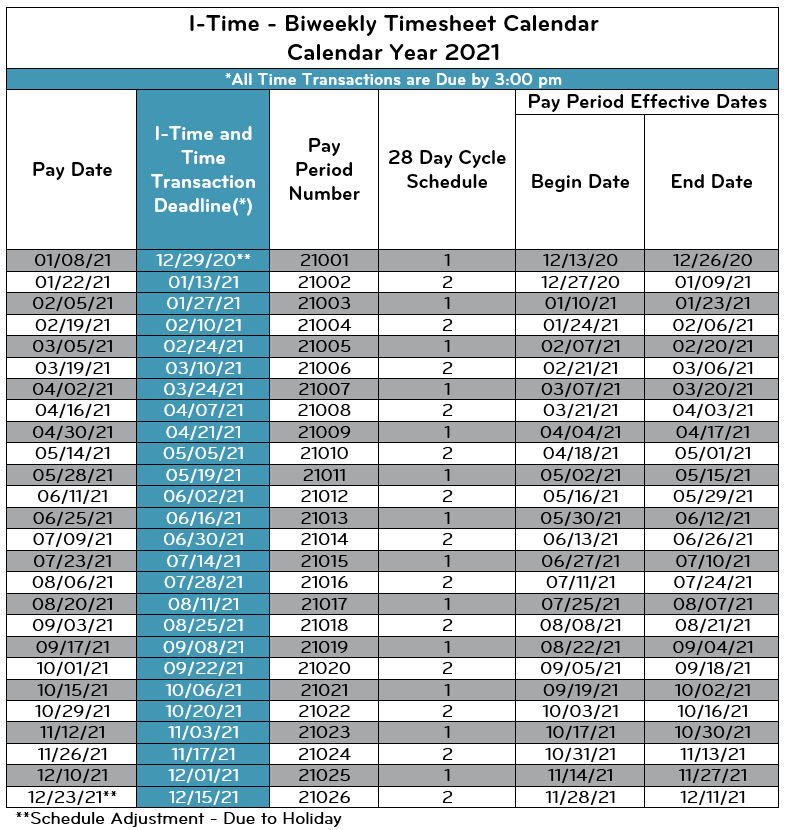

Chime Bank Direct Deposit Time

Manual via direct deposit form

Go to Settings > Account Information > Set Up Direct Deposit > Get direct deposit form

- If you click “Get direct deposit form,” we’ll instantly email you a PDF version of the form.

- Check your email, and open the PDF form.

- In the “Amount” section, check one of the following boxes: Deposit my entire paycheck, Deposit $__ dollars of my paycheck, Deposit __% of my paycheck.

- Choose the amount of your paycheck you want to be deposited and sign at the bottom.

- In the “Authorization” section, write in your employer or payer’s name.

- Sign and send it to your Human Resources department, payroll provider, or manager!

Automatic via employer portal

- Log directly into your payroll provider portal (like ADP, for example) to update your payment method.

- Enter your account information into the portal.

- Choose the amount of your paycheck you’d like to deposit and save your changes.

- Confirm with your Human Resources department, payroll provider, or manager that everything was set up correctly.

Chime Mobile Direct Deposit Time

☝️ Note: You can follow the same steps if you’re depositing unemployment benefits. Just make sure you’re using your state’s government portal instead of your payroll provider.

🚩 Direct deposit capability is subject to payers' support of this feature.

Chime Direct Deposit Holiday Delay 2020

Once your direct deposit is all set up and approved by your employer, you can expect to receive your first Chime deposit within your next 2 payment cycles.

On top of that, you’ll unlock all kinds of new features as a Chime member! Here are a few:

Get paid early¹

Get your paycheck up to two days earlier with direct deposit. This is a feature we offer by making your money available as soon your employer sends it – which is often up to two days before some traditional banks make the funds available to you.

SpotMe

Our SpotMe feature lets you overdraft up to $100 on debit card purchases with no fees². All Chime members with $500 or more in monthly qualifying direct deposits are eligible to enroll.

Credit Builder

Eligible Chime member⁴ can get access to our first-ever secured credit card, made to help you build credit over time by offering automatic payments and reporting your progress to the major bureaus every month.⁵ There’s no credit check to apply, plus it has no fees, no interest, and no minimum security deposit³.

In a nutshell, direct deposit is easy and free to set up. And by doing so, you’re able to get the most out of Chime—by getting paid earlier¹, overdrafting without the fees², and working on your credit!