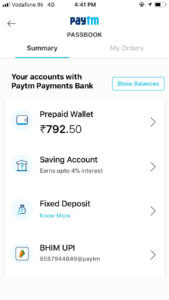

Firstly, we know that what is Paytm Payment Bank, after that we will know how to add or deposit money in Paytm Payment Bank account? What is Paytm Payment Bank? Paytm Payment Bank is India’s first mobile bank where you can open your account with zero balance. In Aug 2015, Paytm Payment Bank was licensed by the Reserve Bank of India. Paytm fixed deposits are actually kept with IndusInd bank because of RBI’s Payment Bank operating guidelines. So it is as safe as opening an FD with IndusInd Bank directly. You can find more details here. Features of Fixed Deposit Account. The main purpose of FD account is to enable the individuals to earn a higher rate of interest on their surplus funds. The amount can be deposited only once.

How Much Loan Can I Get?

What Is the Rate of Interest?

What Is the Loan Tenor? How Is the Loan Repaid?

The loan tenor can’t exceed tenor of the deposit.

You can close the loan whenever you wish.

What Are the Benefits?

Points to Note

Does Loan Against Fixed Deposit Make Sense?

- You can break the FD prematurely and use the funds to meet your requirement.

In general, do not opt for loan against your bank fixed deposit. Rather, break your fixed deposit and use the funds to meet your requirement.

When Can Loan Against FD Make Sense?

I can foresee utility of loan against FD if the loan amount is much lesser than the FD amount and the interest rates have gone down significantly after you opened the fixed deposit. Penalty for breaking FD is also important variable.

Paytm Fixed Deposit Transaction

Paytm Fixed Deposit Interest Rate

- If you do not break the fixed deposit