- Td Tax Free Savings Account Interest Rate

- Td Tfsa Savings Account Interest Rate

- Td Canada Savings Account Interest Rate

- Td Bank Savings Account Interest Rate

Get special rates and discounts.

TD Bank’s Simple Savings account offers almost no interest. The bank’s Beyond Savings account, which requires a $250,000 balance to earn the highest rate, pays more than.

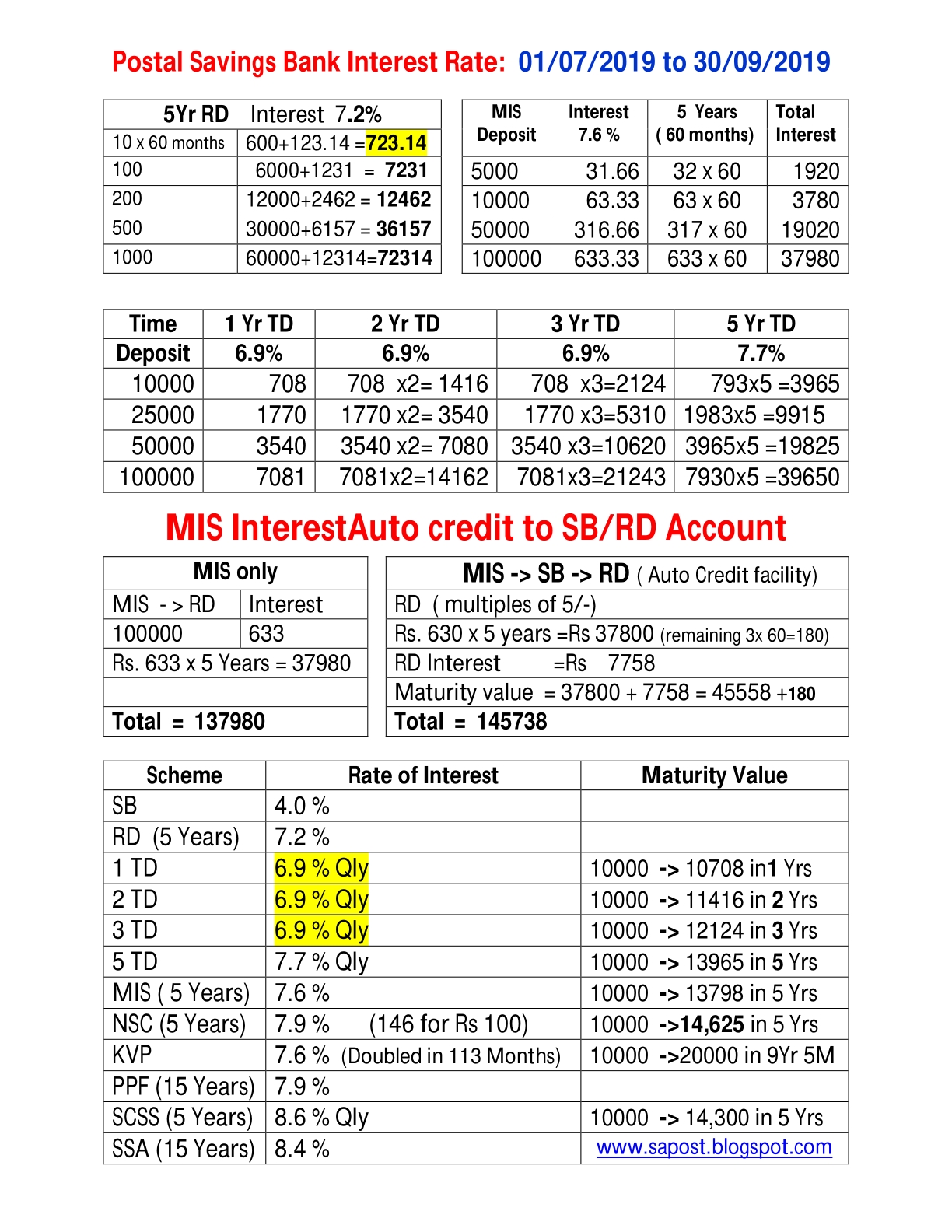

1 This account earns a higher rate of interest than the TD Every Day Savings Account. 2 No transaction fees for transfers from this account to another TD chequing or savings account when using EasyWeb Internet Banking or the TD app, except for transfers by cheque or through Interac e-Transfer® and no transaction fees for pre-authorized transfer services from this account to another TD. What fees does TD Bank Preferred Savings Account charge? TD Bank Preferred Savings Account does not charge a monthly maintenance fee. See the fee breakdown section below to view all fees. Our savings account interest rates. Earn interest and save. 1 No transaction fees for transfers or pre-authorized transfer services from this account to another TD chequing or savings account, except for. To open an account in Small Savings Schemes viz Savings Account (SB), Recurring Deposit (RD), Time Deposit (TD), Monthly Income Scheme (MIS), Senior Citizen Savings Scheme (SCSS)submit Account.

Opening your TD Checking account

is just the beginning – take advantage

of these added relationship benefits.

As a TD personal Checking customer, you get special rates on savings accounts and discounts on home lending solutions. Get the most out of your Checking today.

Get rewarded for building your savings with tiered interest rates. And you can earn an even higher rate by linking your TD personal Checking account to a TD Preferred Savings account.1

Td Tax Free Savings Account Interest Rate

TD personal Checking customers receive an extra 0.25% discount off our already low variable rates. Get the most out of your home today.2

Td Tfsa Savings Account Interest Rate

At TD Bank, there's always someone to talk to about your account. Call us or come in today.

1-888-751-9000

Live Customer Service 24/7

Td Canada Savings Account Interest Rate

1Qualifying accounts include TD Bank personal mortgage, home equity, credit card or active personal and business checking accounts. An active checking account must have three customer-initiated deposit, withdrawal, payment or transfer transactions each month to qualify for the rate bump during the following month.

Td Bank Savings Account Interest Rate

2Available on 1-4 family primary or secondary residences, excluding mobile homes, and homes for sale, under construction or on leased land. A qualifying TD Bank personal checking account is required to be eligible for an additional 0.25% discount. This relationship discount may be terminated and the interest rate on this account may increase by 0.25% upon closure of the qualifying checking account. Rates subject to change.

Loans subject to credit approval.

TD Bank is working to reduce our environmental impact. Find out how